The Government of Canada rolled out a new rent subsidy retroactively covering September 27, 2020 until June 2021. This new rent subsidy is similar to the previous rent subsidy originally announced at the beginning of the pandemic, however, this version does not require the participation of landlords.

Eligibility criteria

To be eligible for the CERS you must meet all four of the following criteria:

- You had a CRA business number on September 27, 2020, a payroll account on March 15, 2020 or you purchased the business assets from another person that had a business number or payroll account on the required dates listed above

- You are a corporation that is not exempt from tax, an individual or a charity

- You experienced a drop in revenue compared to the same month in the previous year or compared to the average revenue earned in January and February 2020. There is no minimum revenue drop required to qualify. The rate your revenue dropped is only used to calculate the subsidy you will receive

- You own or rent a qualifying property that incurs eligible expenses

- Qualifying property

- A qualifying property includes Canadian buildings or land that you own or rent and use in the course of your ordinary activities. Your home, cottage, other residence, or rental property used by a non-arm’s length (related) party do not qualify.

- Eligible expenses that can be claimed

- Eligible expenses include amounts paid or payable to arm’s length parties during the claim period that were under written agreement in place before October 9, 2020 (or a renewal with substantially similar terms)

- The maximum eligible expenses that can be claimed is $75,000 per business location and $300,000 in total for all locations

- To claim unpaid eligible expenses, these amounts must be paid within 60 days of receiving the CERS payment

- Qualifying property

Eligible expenses for qualifying rental properties

If you have a rental property, eligible expenses include base rent, property insurance, utilities, common area maintenance, property taxes and customary ancillary services. You cannot claim tenant insurance, leasehold improvements, sales taxes, damages, interest or penalties on unpaid amount or other special amounts.

Eligible expenses if you own a qualifying property

If you own a qualifying property, eligible expenses include, property taxes, property insurance, and mortgage interest. You cannot claim mortgage interest on mortgages that exceed the cost of the property, paid or payment amounts that fall outside the claim period or payments between non-arm’s length parties.

Lockdown support

The new rent subsidy includes an additional lockdown support of 25% for business that were required to shut down or significantly limit their activities due to health orders issued under Canada, the province or reginal law.

Claim periods

The CERS applications must be filed within 180 days after the claim period. The current claim periods are as follows:

Claim 1: September 27 to October 24, 2020

Claim 2: October 25, 2020 to November 21, 2020

Claim 3: November 22, 2020 to December 19, 2020 (upcoming)

Calculating the subsidy

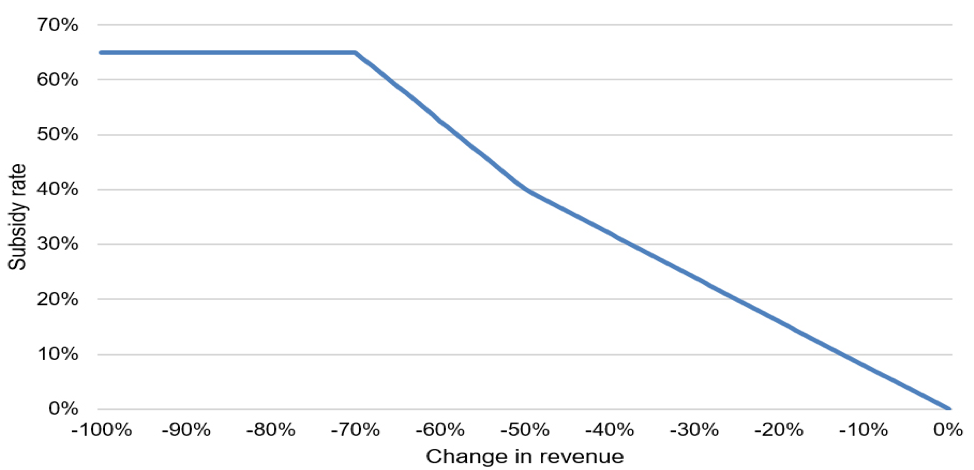

The subsidy calculation takes into account your eligible expenses up to the maximum claim amounts listed above, your base rent subsidy rate that is based on your revenue drop (see the tables below) and your lockdown support (if you qualify for this top up rate).

| Revenue Decline | Base Subsidy Rate |

| 70% and over | 65% |

| 50% to 69% | 40% + (revenue drop – 50%) x 1.25 (e.g., 40% + (60% revenue drop – 50%) x 1.25 = 52.5% subsidy rate) |

| 1% to 49% | Revenue drop x 0.8 (e.g., 25% revenue drop x 0.8 = 20% subsidy rate) |

How to apply

You can apply for the CERS using your CRA online account. The following Government of Canada link provides additional details about the subsidy and online calculators to assist with determining your allowable claim amount. https://www.canada.ca/en/revenue-agency/services/subsidy/emergency-rent-subsidy/cers-how-apply.html

If you have any questions or would like assistance with the application process, we at Argento CPA would be happy to be of service.