-

7 Ways to Improve Profitability

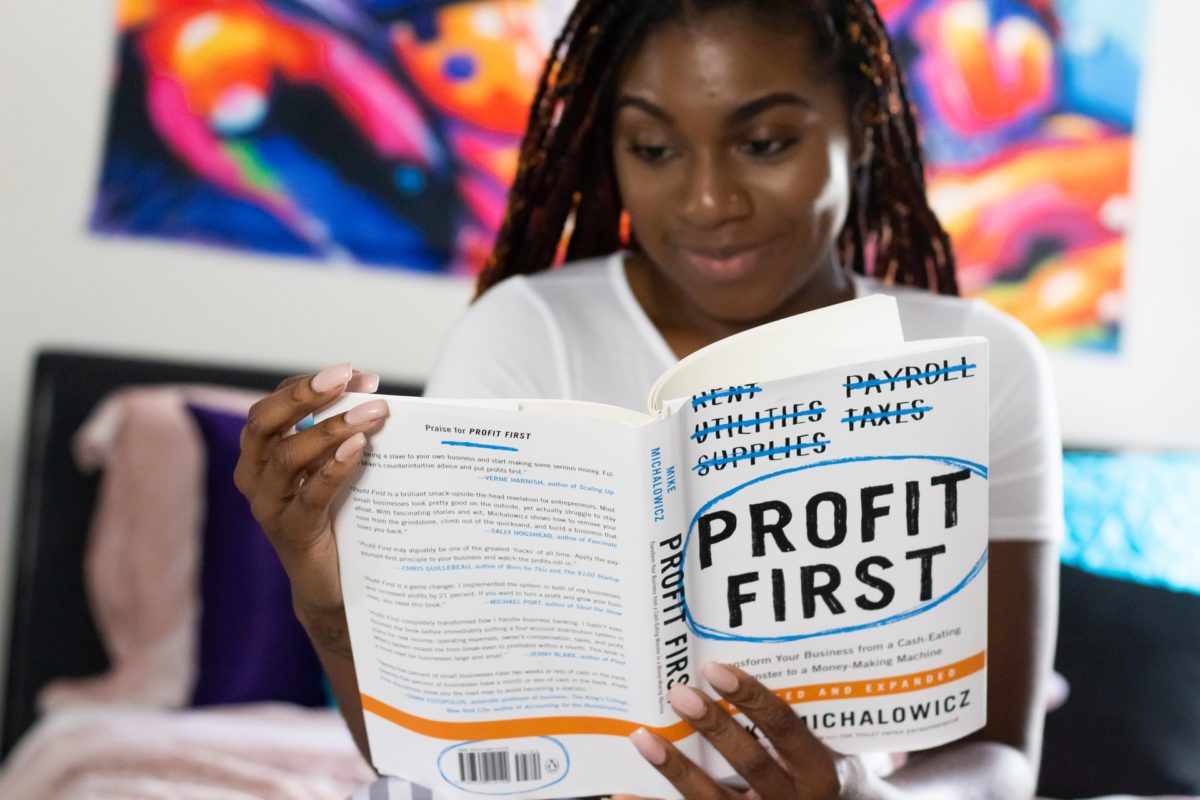

Wanting to improve profitability but not sure where to start? Check out these efficient, reliable, and proven ways to accomplish this vital business goal of increasing profit! 1. To Improve Profitability, Invest in Your Staff When you hire someone, you expect them to make more money for the business than you have to pay them. […]

-

Best Time Management Tips For Business Owners

As you’ve probably experienced by now, time management is essential as time is the most valuable asset you possess. And if you’re like most business owners, you’re eager to find ways to maximize your time. This is why learning and implementing time management practices is so critical for business owners. Here are some of our […]

-

7 Cash Flow Tips for Trade Service Businesses

The importance of cash flow can’t be stressed enough. As a trade service business owner, managing your finances probably doesn’t rank high on your to-do list. Focusing on a strong cash flow isn’t a top priority. Let’s reverse that course of direction. That way, your business can stay in the black this upcoming holiday season […]

-

How Your Budget vs Actual Report Helps You Reach Your Goals

With a busy business and not much time to really dive into financials or create a well thought out budget, it’s important you know which reports produce the most value and which provide you with the most insight in the least amount of time. We’d argue budget vs actuals are the set of reports that […]

-

Do you need a Compilation Engagement?

Historically, your accountant probably issued an NTR as part of their offering, sometimes without considering who the users of the financial statements will be. Assuming you don’t need a Review or Audit Engagement and before choosing a Compilation Engagement, ask yourself this, “do you have any third parties that intend to use the financial information?” […]

-

Hire an Accountant to Prepare for a Successful Business

Starting a business is always an exciting time, but it can also be daunting. There are so many things that need to get done before you even start your business. One thing that often gets overlooked is hiring an accountant. Hiring an accountant will help you prepare for the future and ensure that your finances […]

-

My business books are a mess, and I am too busy to get them organized!

Businesses have two choices when their business books get so messy – either decide whether it is worth their time to do it themselves or hire professional accountants who will do all the hard work involved. We suggest the latter. Most businesses of all sizes fail to manage their business books, and they do this […]

-

Canadian Taxation of Stock options – Part 2

Part 1 of this 3-part series explained the taxation of U.S. stock options. In this article we will discuss the tax implications of Canadian stock options. The tax consequences resulting from Canadian stock options is differentiated by the type of company that is granting the option. This is because stock options grant by Canadian controlled […]

-

Tips for Cloud Accounting and Online Bookkeeping

Welcome to the 21st century! A new paradigm for accounting through cloud computing. Digitization and automation are progressing quicker than what most people can keep up with. Business owners are constantly bombarded by new apps and technology that seem to be getting better and better. Is your accounting system equipped with the latest and greatest […]