-

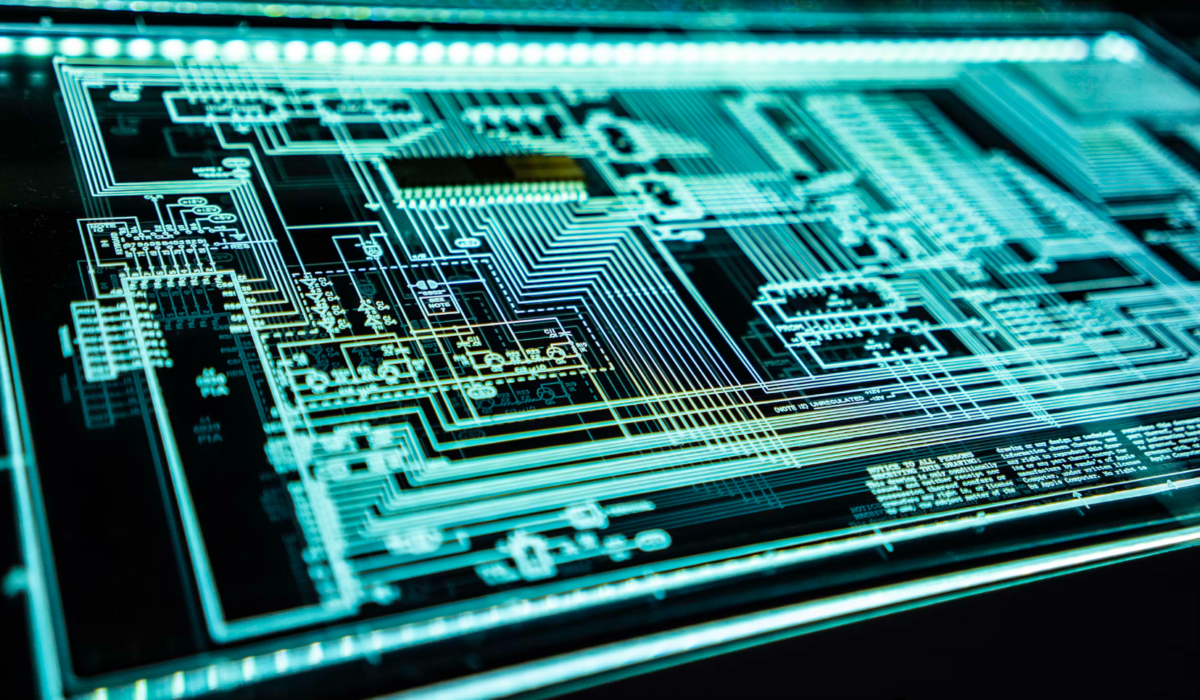

How Can Tech Companies Get Funding in Canada

Canada is home to a thriving tech industry that has seen significant growth in recent years. With a supportive government, access to top talent, and a strong innovation culture, the country has made leaps in this space. However, any growth in tech is only possible if startups and established tech companies have access to sufficient […]

-

8 Benefits of Outsourced Accounting

Need Help with In-House Accounting for Your Business? Consider These 8 Benefits of Outsourced Accounting Managing a business is no small feat. It takes dedication, perseverance, and the ability to wear many hats. But for many business owners, managing their day-to-day operations, fulfilling orders, leading a team, and ensuring customer satisfaction can be too much […]

-

Introduction to SaaS Finance

SaaS finance is integral to the success of startups. SaaS companies typically refer to their customers as ‘members’ and rent software to users on a rolling basis. By understanding what the key SaaS finance metrics are to track, including how equity financing, revenue-based financing, growth funds, and private equity can be leveraged, you can effectively […]

-

Argento’s Skool Community

In the past year, our team took a deep dive into digital tools and how they can better serve businesses. This wasn’t just about getting to grips with the latest software or gadgets; it was about understanding the real, on-the-ground needs of businesses today. From strategic planning to choosing the right tech, from finding the […]

-

How to Prepare for Economic Challenges: A Case Study on Securing $15K Grants and $100K 0% Interest Loans for Our Client

How I helped our client prepare for oncoming economic challenges while getting them access to a $15k grant and $100k 0% interest loan. Let’s face it – the economic landscape has changed on so many levels. Now more than ever, business owners need to pay close attention to what they are focusing on. In this […]

-

The Power of a Good Business Advisor

The Importance of a Business Advisor Just like a superhero needs a trusty sidekick and an athlete needs a coach, a thriving business requires the guidance of a skilled business advisor. As a business owner, you’re likely familiar with juggling a plethora of roles and responsibilities. You’re the idea generator, the decision-maker, the problem-solver, and […]

-

Why do you need Strategic Business Planning?

Why do you need Strategic Business Planning? One of the most significant challenges businesses faces is the need for more information. The lack of information can lead to missed opportunities, costly mistakes, and a failure to stay competitive. As a business owner, seeking out and accessing accurate information to make informed decisions and avoid these […]

-

Effective Leadership

Effective Leadership Effective leadership is the cornerstone of any successful organization. A good leader sets the direction, inspires others, builds trust, adapts to change, and creates a positive work culture. In this blog, we’ll explore what it takes to be an effective leader and the key traits of a great leader. Vision and Strategy Influential […]

-

Streamlining Business Operations: Apps Made Easy

As a busy entrepreneur or business owner, we know it can be a real challenge streamlining business operations with the seemingly endless number of applications and software tools available. With so many choices and so little time, it’s no wonder that finding the right solutions to streamline your business can feel like an overwhelming task. […]

-

Becoming a Digital Advisor

Journey through the Digital Landscape: Chronicles of an IT Veteran Turned Digital Advisor In my 25 years as an IT professional, I have traversed the diverse terrains of various industries, each with their unique challenges and opportunities. Each experience painted a vivid picture, reaffirming that people and processes are at the very heart of every […]